What Is ACPG?

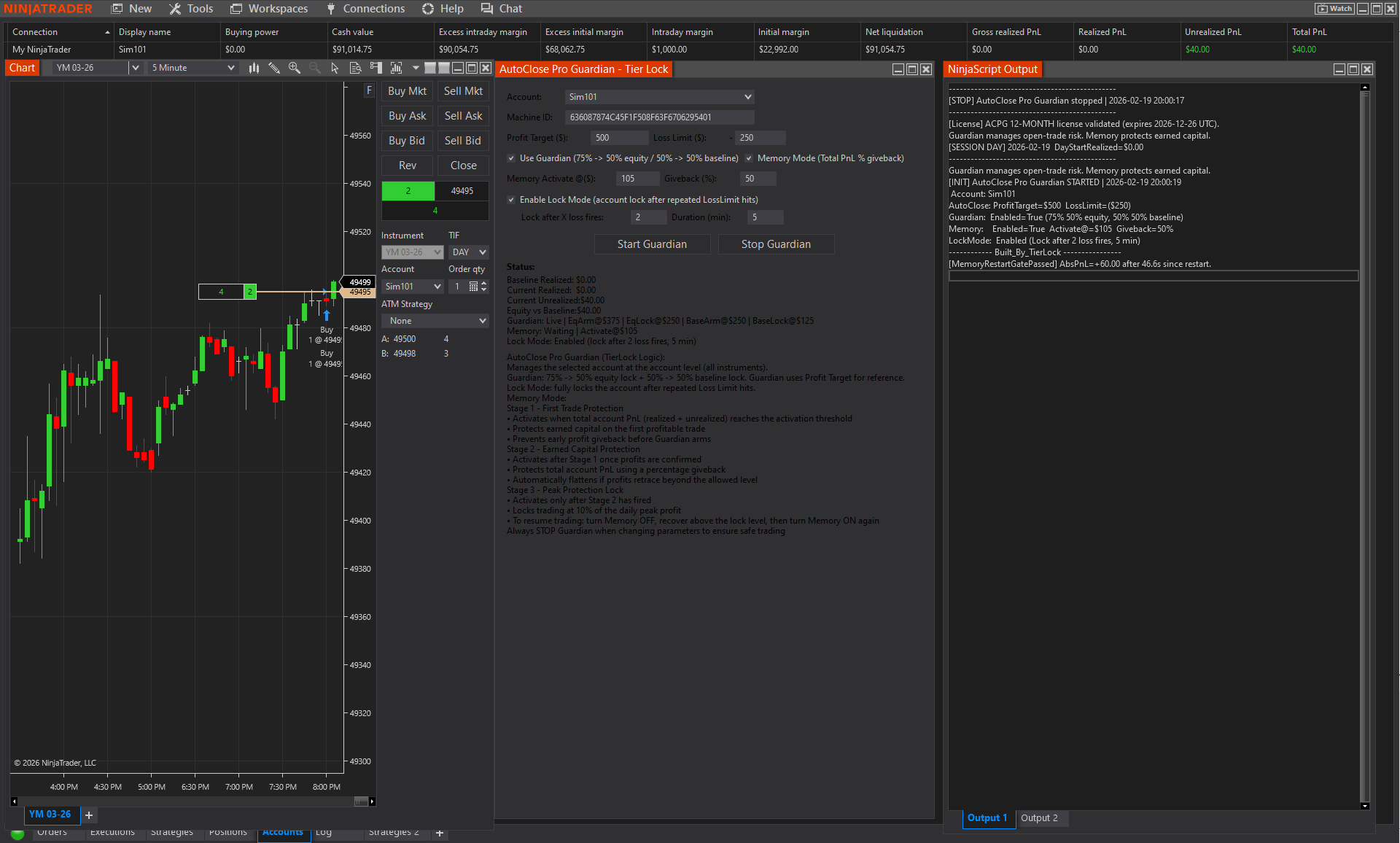

AutoClose Pro Guardian (ACPG) is an advanced extension of AutoClose Pro (ACP) designed for traders who require **multi-layered account protection** beyond simple profit targets and loss limits.

ACPG continuously evaluates account-level risk, adapts to changing equity conditions, and enforces discipline during both winning and losing cycles.

Real-World Problem ACPG Solves

Many traders can build profit, but fail to protect it due to hesitation, overconfidence, or emotional decision-making. ACPG exists to protect traders from themselves when conditions deteriorate.

Learn more about structured risk enforcement inside our NinjaTrader risk management knowledge base .

How ACPG Helps Traders Manage Risk

ACPG operates as a supervisory layer that enforces risk automation, profit protection, and loss containment.

AutoClose Pro Guardian is engineered specifically for NinjaTrader 8 traders who require advanced daily loss enforcement, adaptive drawdown protection, profit memory locking, and mechanical risk governance inside prop firm environments.

Built for Prop Firm Daily Loss Rule Compliance

Many prop firm traders fail evaluations not because of strategy — but because they violate structured daily loss rules.

ACPG enforces adaptive daily drawdown control aligned with common prop firm evaluation requirements, helping traders avoid rule breaches and forced account resets.

Learn more about how structured enforcement applies inside NinjaTrader 8:

Key Risk Protection Concepts

- Adaptive protection during drawdowns

- Profit floor enforcement to prevent giveback

- Multi-stage response to losses

- Reduced exposure during psychological stress

Explore ACPG Features in Detail

Guardian logic, Memory profit locking, Lock Mode behavioral shutdown, daily loss enforcement, and adaptive risk supervision.

ACPG is not a simple daily stop tool — it is a layered account-level enforcement engine.

Using ACPG vs Not Using It

With ACPG Enabled

Traders operate within defined limits, protecting psychological capital and avoiding catastrophic loss cycles.

Pros

- Consistent discipline

- Capital preservation

- Reduced emotional errors

- Prop-firm compliant risk enforcement

Cons

- Less discretionary flexibility

- Requires trust in automation

Without ACPG

Traders rely entirely on discretion during periods of stress, increasing the likelihood of overtrading , revenge trading, and excessive drawdown.

Pros

- Maximum flexibility

Cons

- Higher emotional exposure

- Inconsistent outcomes

- Risk of account failure

Who ACPG Is Built For

- Prop firm evaluation traders

- Funded account operators

- High-frequency discretionary traders

- Traders recovering from discipline breakdown

- Professionals requiring structured capital protection

Live ACPG Demonstrations

See how AutoClose Pro Guardian enforces daily loss limits, protects unrealized gains, activates Memory logic, and applies Lock Mode behavioral control.