What ACPG Is Designed to Do

AutoClose Pro Guardian (ACPG) is not a trading robot, signal service, or decision-making engine. It does not place trades, predict markets, or determine entries and exits.

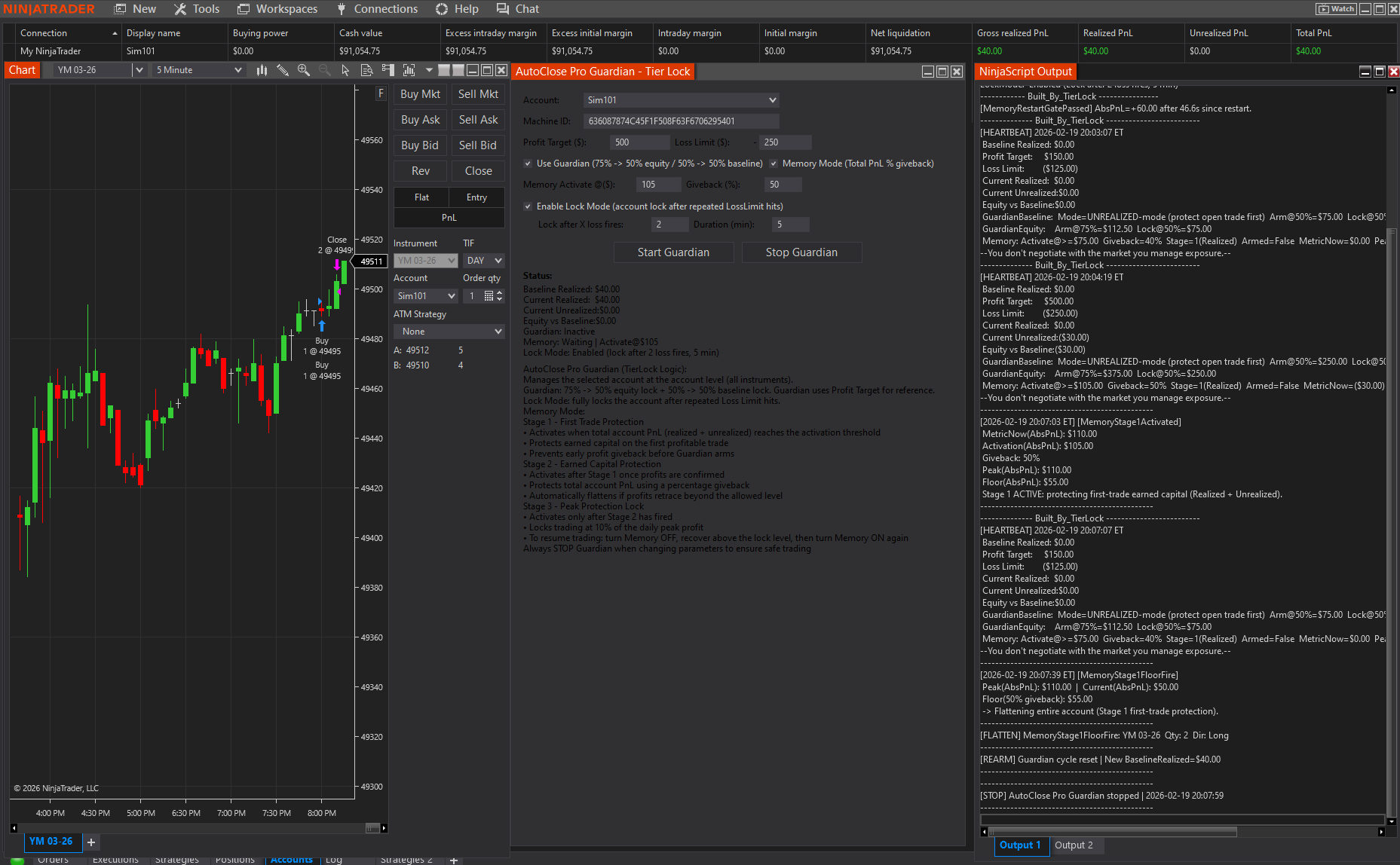

ACPG builds upon the foundation of AutoClose Pro and exists for one purpose: to enforce professional-grade risk management and accountability at the account level.

Guardian Logic: Intelligent Risk Supervision

Adaptive Protection, Not Static Limits

Traditional risk tools rely on static daily loss or profit targets. ACPG’s Guardian logic is designed to adapt based on account-level risk and changing equity conditions.

As performance improves or deteriorates, Guardian logic adjusts how aggressively protection is applied — tightening controls when risk increases and allowing flexibility when conditions are stable.

Why Guardian Logic Is Sound Risk Practice

Professional risk management is never “all or nothing.” Institutions manage exposure dynamically, not emotionally. Guardian logic mirrors this principle by responding to actual account behavior rather than trader impulses.

Memory & Profit Protection

Protecting Profits From Giveback

One of the most common trader failure modes is giving back hard-earned gains due to overconfidence or loss of focus.

ACPG uses memory-based protection to recognize drawdown from peak equity and intervene before damage becomes unrecoverable.

This approach aligns with structured profit protection methodologies used by professional traders.Accountability & Lockout Behavior

Designed for Traders Who Want Accountability

ACPG includes lockout behavior for traders who explicitly want to be held accountable to predefined rules.

When certain conditions are met, ACPG can prevent further trading activity — removing the ability to “just take one more trade.”

Inputs Matter: ACPG Is a Tool, Not a Robot

ACPG does not decide what values are appropriate for your account. It enforces what you configure.

The user must input variables that reflect account size, risk tolerance, trading style, and experience level.

Poor inputs will produce poor outcomes. Thoughtful configuration produces professional-grade protection.

Why ACPG Is a Best Practice for All Skill Levels

For Developing Traders

ACPG prevents catastrophic mistakes during the learning phase, preserving capital and psychological capital.

For Professional & Prop Traders

ACPG enforces consistency, compliance, and emotional neutrality — requirements for long-term account longevity.

ACPG as Elite Account Management Infrastructure

At its core, ACPG functions as an automation layer — supervising behavior rather than execution.

This makes ACPG not just a safety net, but a framework for elite-level account management and accountability.

For traders operating under evaluation rules, review our guide on prop firm daily loss rules in NinjaTrader 8 to understand how structured enforcement aligns with compliance requirements.